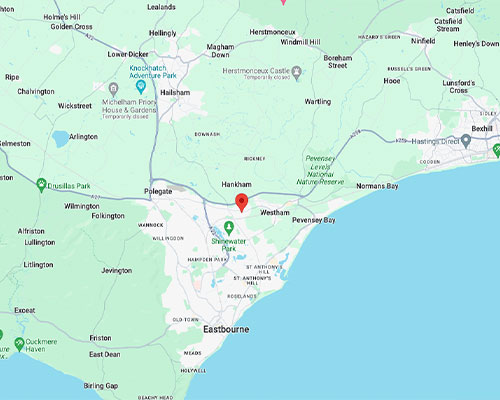

Splitting assets in a divorce can be one of the most difficult and emotional aspects of the process. Here at Sol Moves, we strive to help all kinds of movers in all kinds of situations. This guide aims to provide a practical and simple approach to dividing assets in a divorce.

It can be hard to make decisions that are fair and in the best interests of both parties. Especially in a situation that is already filled with tension and hurt feelings. Our goal is to help both parties come to a fair and equitable agreement.

We offer advice on how to make decisions that are fair and just. We hope it will help both of you move forward with your lives.

Overview of the process of splitting assets in a divorce

There are two types of assets: marital assets, and non-marital assets. Marital assets are those that were acquired during the marriage. Non-marital assets are those that were acquired before the marriage or after the date of separation.

Make sure to account for any debt that is owed, both separately and jointly. This can include debt such as mortgages, car loans, credit card debt, or any other financial obligations that the parties are responsible for. When dividing assets in a divorce, the goal is to split these things as equitably as possible.

It is important to keep in mind that the decisions you make today may have effects for years to come. A fair and equitable settlement when splitting assets in a divorce will help both parties move forward with their lives.

Types of assets that need to be divided

There are many different types of assets to be divided in a divorce, regardless of whether they are considered marital or non-marital. Some examples of assets that may need to be divided are:

- Retirement accounts. Whether they are employer-sponsored or self-directed accounts, retirement accounts will need to be divided in a divorce.

- Investment accounts. This can include any stocks, bonds, and other securities that the parties hold.

- Bank accounts. Whether they are savings or checking accounts, these will need to be divided.

- Credit card balances. Both parties will need to find a way to account for the debt that is on these cards.

- Business interests. If either party has a business interest that was acquired before the marriage or after the date of separation, it will need to be divided.

- Business debt. If either party has a business interest that was acquired before the marriage or after the date of separation, it will need to be divided.

How to make decisions that are fair and just

Although the decisions you make may seem cut and dry at the time, you never know what the future may hold. This can make it difficult to make an equitable decision that is truly fair, and that will stand the test of time. With this in mind, it can be helpful to consider the following suggestions as you make decisions about how to divide assets in a divorce.

- Consider the length of your marriage. This can make a fair and equitable decision about the division of assets even more challenging. While it may be tempting to consider only the financial aspects of the marriage when dividing assets in a divorce, it can be helpful to also consider the length of the marriage when making decisions.

- Consider each other’s financial circumstances at the time of the divorce. It may be helpful to look at both parties’ financial circumstances at the time of the divorce to make an equitable decision.

- Consider each other’s future financial circumstances. It can be helpful to consider both parties’ future financial circumstances when dividing assets in a divorce.

- Account for debt. Account for all debt as you make decisions about the division of assets in a divorce. This can help ensure that both parties are treated fairly and that both parties have an opportunity to move forward with their lives.

Dividing marital assets

As discussed above, the majority of the assets that need to be divided in a divorce will be considered marital assets. This is because the vast majority of assets will have been acquired during the marriage. When it comes to dividing marital assets, it is important to understand that the court will look to equitably divide them.

This means that the court will try to divide the assets in a way that is fair to both parties. It will not necessarily be in the best interest of either party to receive everything they ask for. When it comes to dividing marital assets, it is important to keep in mind that there is no one-size-fits-all solution.

While there may be some general rules to follow when dividing assets in a divorce, the courts will look at each situation as unique. This means that the courts will take into consideration all relevant factors, including:

- Length of the marriage

- Age and health of each party

- The ability of each party to work and earn an income

- Debt and other financial obligations

- Contribution of each party to the acquisition of assets

- Contribution of each party to the acquisition of debt

- Standard of living established during the marriage

- Earning capacity of each party

- Standard of living each party will likely have after the divorce

Dividing non-marital assets

Non-marital assets are those that were acquired before the marriage or after the date of separation. This can include assets such as personal property, real estate, and stocks and bonds. When it comes to dividing non-marital assets, the court will follow a different standard than it does for marital assets.

Instead of trying to equitably divide them, the court will look to give them to one party or the other. There are a few different ways that the courts can make decisions about the division of non-marital assets.

- One party is awarded the property while the other party is given a monetary award in exchange.

- Both parties are awarded the property, but one party is awarded additional money to compensate for their share of the non-marital asset.

- One party is awarded the property, but the other party is awarded additional money to compensate them for giving up the non-marital asset.

Dividing retirement accounts

When splitting assets in a divorce, retirement accounts are generally the largest assets that people have. They may make up a substantial portion of the overall value of a couple’s assets. Especially if one or both parties are only a few years from retirement.

If you are dividing them in a divorce, you will want to make sure you understand the relevant laws and how they apply to your specific situation. Retirement accounts can be divided into one of three ways. The first way is through a rollover, where the funds are transferred from one account to the other.

This can be difficult because there may be significant tax issues, and it may not be practical depending on the type of accounts being transferred. The second way is to treat each retirement account as a separate asset that must be divided between the parties. The third way is to treat one retirement account as the “retirement asset” and the other as a “retirement liability.”

Dividing business assets

Depending on the type of business that the parties run, it may also be necessary to divide business assets and liabilities in a divorce. Business liabilities are things like debts that the business owes. It is important to consult with an attorney who is knowledgeable about how you can transfer these things from one party to the other.

In general, business assets and liabilities can be divided into one of three ways. The first way is to treat each asset and liability as a separate asset or liability that must be divided between the parties. The second way is to treat the entire business as a single asset or liability that must be divided between the parties.

third way is to treat one business asset or liability as the “business asset” or “business liability” and the other as a “non-business asset” or “non-business liability.”

Dividing real estate

If you are divorcing a spouse who owns real estate, you will likely have to determine how to divide the real estate assets. There are a few different ways to do this. The simplest way is for the parties to take the title in their names.

The other party will simply give their interest in the real estate to the other party, and the parties will then take the title in their names. This process is a “quit claim” transfer. If you want to retain joint ownership of the real estate, you can also sign a joint tenancy agreement.

This allows you to retain your joint ownership but gives the other party the right to inherit your share of the real estate in the future. While it is possible to divide the real estate assets through a simple quit claim transfer, dividing the assets through a formal appraiser-determined value may make the division more equitable and fair.

You should consult with a real estate attorney to determine the best course of action to make the division equitable.

Dividing personal property

The easiest way to divide personal property assets is to assign their value and divide them equitably between the parties. You may also want to consult with a personal property appraiser to determine the value of some items. This can help to ensure that the division is equitable and fair.

If you are dividing a significant amount of personal property, it may make sense to use an auction house to help with the division process. This can help to make the process of splitting assets in a divorce more efficient. It may also be cheaper than hiring an appraiser.

Tips for making the process easier

When it comes to dividing assets in a divorce, there is no one-size-fits-all approach. Every situation is unique and may require a different approach to the division process. However, there are a few things that can help to make the process easier.

First and foremost, make sure that you and your spouse are being honest about the amount and value of all assets. Avoid mistakes or misrepresenting of any assets. There are several ways to ensure that both parties are being honest and transparent about their assets.

You can and should exchange financial documentation, such as tax returns and bank and investment account statements. You should also sign a valid and binding marital property disclosure agreement. These types of documents will help you both come to an accurate and honest understanding of the financial situation and will help reduce the likelihood of later disputes when splitting assets in a divorce.